Why it matters

Understanding how money grows in a savings account could motivate your child to save.

What is interest?

Explain that interest is money a bank pays you for keeping savings there. The bank sets interest rates—what it pays per dollar saved. Higher rates mean bigger payments.

How it works: Younger kids

Start with simple interest—money paid only on your child’s contributions. Give them a dime for every $1 they save. Keep the money in a clear jar so they can see it add up.

How it works: Older kids

Move on to compound interest. Explain that compound interest is what happens when your interest earns interest.

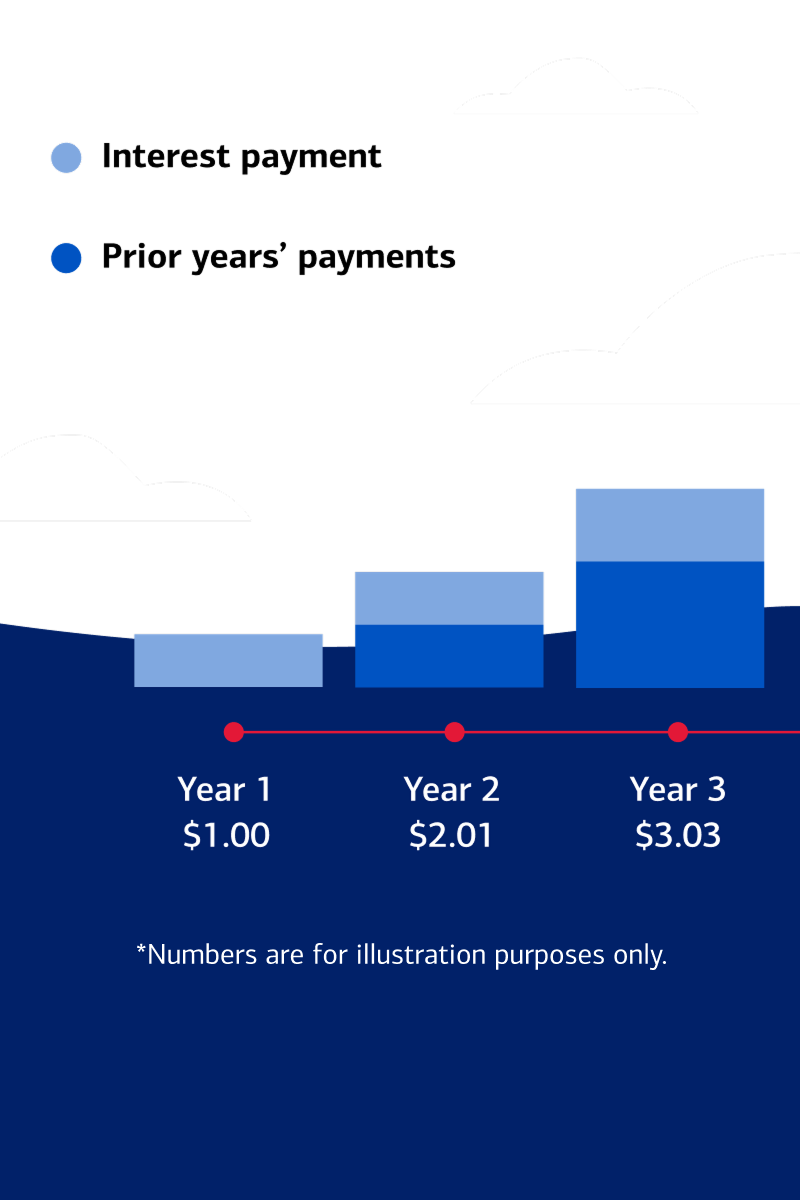

See how it grows...

Use savings account statements to show interest payments rising even when no new money is deposited. Here’s how interest payments add up on $100 earning 1%.*

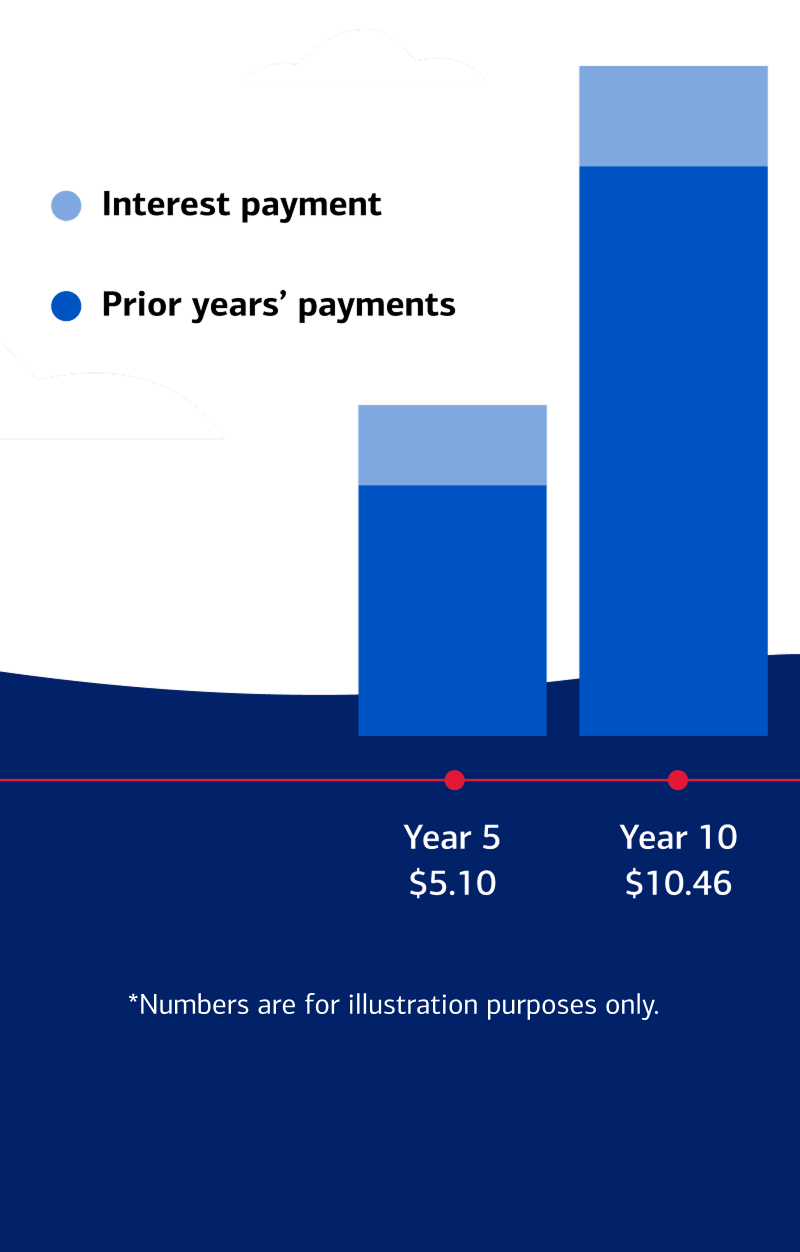

...and grows

In 10 years, $100 grows to about $110.* You and your child can create more scenarios with this compound interest calculator.

Play the long game

Help your child develop good lifelong habits by:

Showing them how to shop for the best interest rates

Routinely reviewing interest earnings

Encouraging patience for long-term gain

You may also be interested in

This material is for informational use only and is not intended for financial or investment advice. Bank of America Corporation and/or its affiliates assume no liability for one’s reliance on the material provided. This material is not updated regularly and may not be current. Consult a financial professional when making financial decisions. ©2025 Bank of America Corporation.