Why it matters

Kids are bombarded with spending messages—from ads they see online to the new sneakers their friends wear to school. It’s important that they learn how to make careful choices.

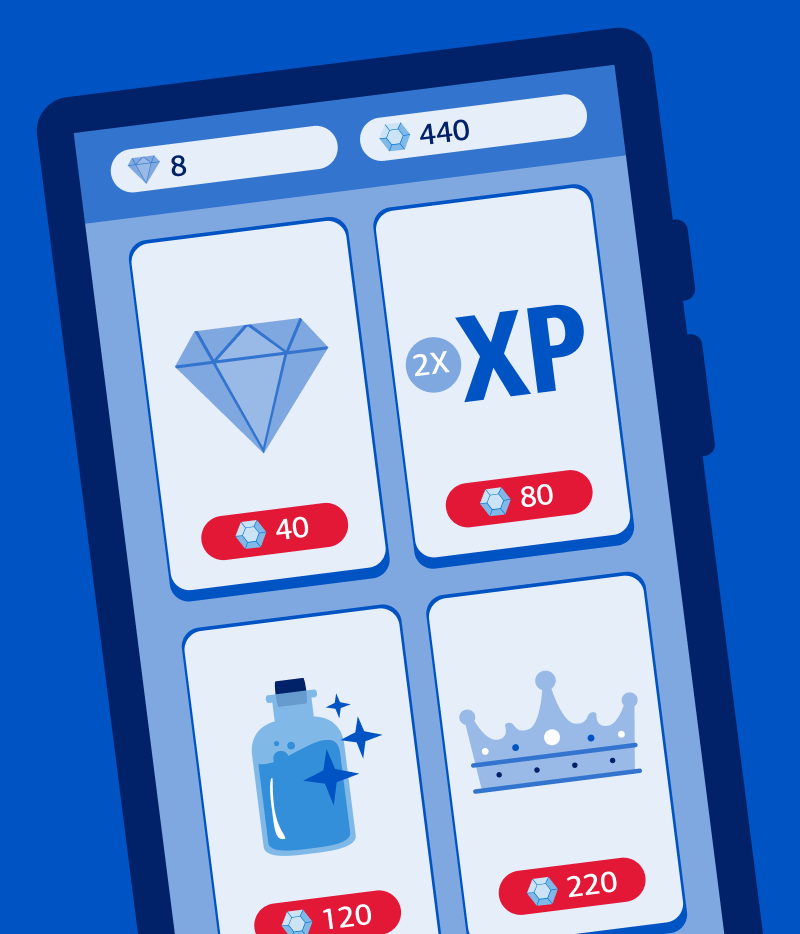

Start with something relatable

Let’s use video games as an example. Players often buy or earn in-game currency, then spend it. Use this to draw parallels between the game’s economics and real life.

Define priorities

Continue the game example to show how goals shape spending. Does your child want to beat the boss? Build a house? Explore? Discuss what to buy to reach the goal.

Connect priorities to spending

As your child plays the game, they can buy tools, gear or materials. Some are useful, some just cool. Use this to talk about the importance of having a spending strategy.

Illustrate trade offs

If your child buys clothes for their character, for example, they may not have enough for tools or gear. Explain that these types of choices apply to all spending decisions.

Talk about the outcome

Is your child pleased or disappointed with how the game turned out? Ask how they’ll play differently next time. And, as you would in real life, encourage them to try again.

Keep in mind it’s a journey

Build skills by routinely involving your child in spending choices, such as:

-

Making shopping lists

-

Researching family purchases, like a TV

-

Deciding whether to buy one item over another

You may also be interested in

This material is for informational use only and is not intended for financial or investment advice. Bank of America Corporation and/or its affiliates assume no liability for one’s reliance on the material provided. This material is not updated regularly and may not be current. Consult a financial professional when making financial decisions. ©2025 Bank of America Corporation.