What is APR and how does it work?

Read, 5 minutes

Key takeaways

- APR, or annual percentage rate, represents the annual cost of borrowing money, including fees, expressed as a percentage; for credit cards, APR is generally just interest.

- Understanding credit card APRs, including how interest payments are calculated, can help you compare offers and find the right card for you.

- A good credit score may help you get lower APRs on credit cards and mortgage, auto and other loans.

You may have seen the term APR, or annual percentage rate, used in reference to everything from mortgages and auto loans to credit cards. Understanding how APRs work can help you make more informed decisions about credit cards and loans. Here’s what you need to know.

What is the difference between APR and interest rate?

APR stands for annual percentage rate and it represents the yearly cost of borrowing money. APR includes the interest rate that applies to your account (credit card, mortgage, line of credit, etc.) plus other fees related to that account. For example, a mortgage APR may include fees for points, underwriting, loan origination and closing costs, in addition to the interest rate. APRs allow you to easily compare the total cost of loans offered by various lenders.

For credit cards, interest rates and APRs are the same. Annual fees, balance transfer fees, foreign transaction fees and other credit card fees are not included in the APRs.

Article continues below

Related content

How do I calculate APR?

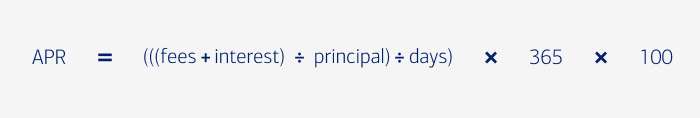

APRs are calculated for you by lenders. It’s important to remember that different lenders may include different fees. When comparing APRs, make sure you consider what fees are included. If you want to run the numbers yourself, you’ll need to know the fees, total interest to be paid over the life of the loan, principal and number of days in the loan term. Here’s the APR formula:

What are the different types of credit card APRs?

Credit cards may have either fixed or variable APRs and will usually have different APRs that apply to different types of transactions, such as purchases, balance transfers and cash advances. Some offer low APRs as limited-time promotions. Many have penalty APRs, which kick in if you miss payments or otherwise violate the terms of the credit card agreement. Check your monthly statement and cardholder agreement for additional information on how each APR is applied. Here’s a look at some of the APRs:

A rate that increases or decreases based on the movement of an index rate, such as the U.S. prime rate. For credit card accounts, the rate will include an index plus some type of margin or percentage added to it.

A rate that doesn’t increase or decrease based on changes to an underlying index rate. The rate can still change, however, if you violate terms of your credit card agreement.

The rate applied to credit card purchases.

The rate for borrowing cash from a credit card. It is generally a higher rate than the rate for purchases.

The rate applied to balances transferred from one account to another.

A higher rate applied to balances as a result of violations of the credit card agreement, such as late payments or exceeding the credit limit.

A rate that is applied to specific transactions, such as purchases or balance transfers, for a limited time. The rate is usually lower than an account’s standard rate. It must last at least six months; some go as long as 21 months.

How do I calculate credit card APR payments?

Generally, credit card companies don’t charge interest on purchases if you always pay your outstanding balance by the due date. If you carry a balance, each purchase usually begins accruing interest on the day the transaction is made. The accrued interest is added to your outstanding balance at the end of each billing period.

The formula to determine how much interest you owe on your outstanding balance may vary by creditor. Here’s a common calculation for interest on purchases:

Let’s say your credit card’s APR for purchases is 20 percent and your average daily balance for purchases during a 25-day billing cycle is $2,000. You can find the APR, average daily balance and days in the billing cycle on your credit card statement.

First, determine your daily periodic rate by dividing the APR by 365 days.

20%

APR

365

days

0.0548%

daily periodic rate

Next, multiply the average daily balance by the daily periodic rate, and then multiply the result by the number of days in the billing cycle.

$2,000

average daily balance

0.0548%

daily periodic rate

25

days in the billing cycle

$27.40

monthly interest charge

So, if these numbers applied to your credit card account, you would owe $27.40 in monthly interest.

If your account has different APRs for different transactions, you need to do the calculation for each one. The interest charges for each APR are broken down on your credit card statement, but you might want to do the calculations before the statement date to get an estimate of what you’ll owe.

One of the most important things you can do is maintain a good credit score. Credit card issuers consider many different factors, including your credit score, in evaluating an application and determining the APRs that will apply. Paying your bills on time, not letting your accounts get close to their maximum credit limits, and monitoring your credit reports are just some of the ways you can help maintain or improve your credit score. Generally, people with better credit scores get better rates than people with lower credit scores.

While a better credit score may be the surest way to lower APRs, getting there can take some time. Here are other actions that can lower your APRs faster:

Some banks and credit card companies will consider requests for lower APRs. Others routinely review accounts to see if a lower APR is warranted. In either case, you have a better chance of getting a lower APR if you consistently pay on time or have taken steps to improve your credit score, such as paying off a big balance.

Many credit cards offer low promotional or introductory rates on balance transfers. Check if your existing cards have any offers or investigate opening a new card with a low rate. While opening a new card could temporarily hurt your credit score, you’ll be better off in the long run as long as you pay off the balance before the promotional rate expires. You should also make sure that the savings from the lower APR is greater than the balance transfer fees, which usually are 3-5 percent of the amount transferred.

Refinancing might be an option for your home and auto loans if interest rates have fallen since you took them out. It also helps if your credit score has improved. When you refinance, you’re paying off the old loan with a new one, so the home or auto needs to be worth more than you owe. You will have to go through the approval process again and pay any associated fees.

Quick tip

While APR is important, it’s just one of the factors to take into account when choosing a credit card that’s right for you. You’ll also want to consider how you plan to use the card and rewards like cash back and airline miles.