If you need money fast, you may be tempted by a payday loan, a short-term, high-cost loan, generally for $500 or less, that is due close to your next payday. However, whether they’re offered by an online payday lender or a check-cashing store in your neighborhood, these loans come with steep costs that can be hard to recover from, and should be considered a last resort after you’ve exhausted all other options.

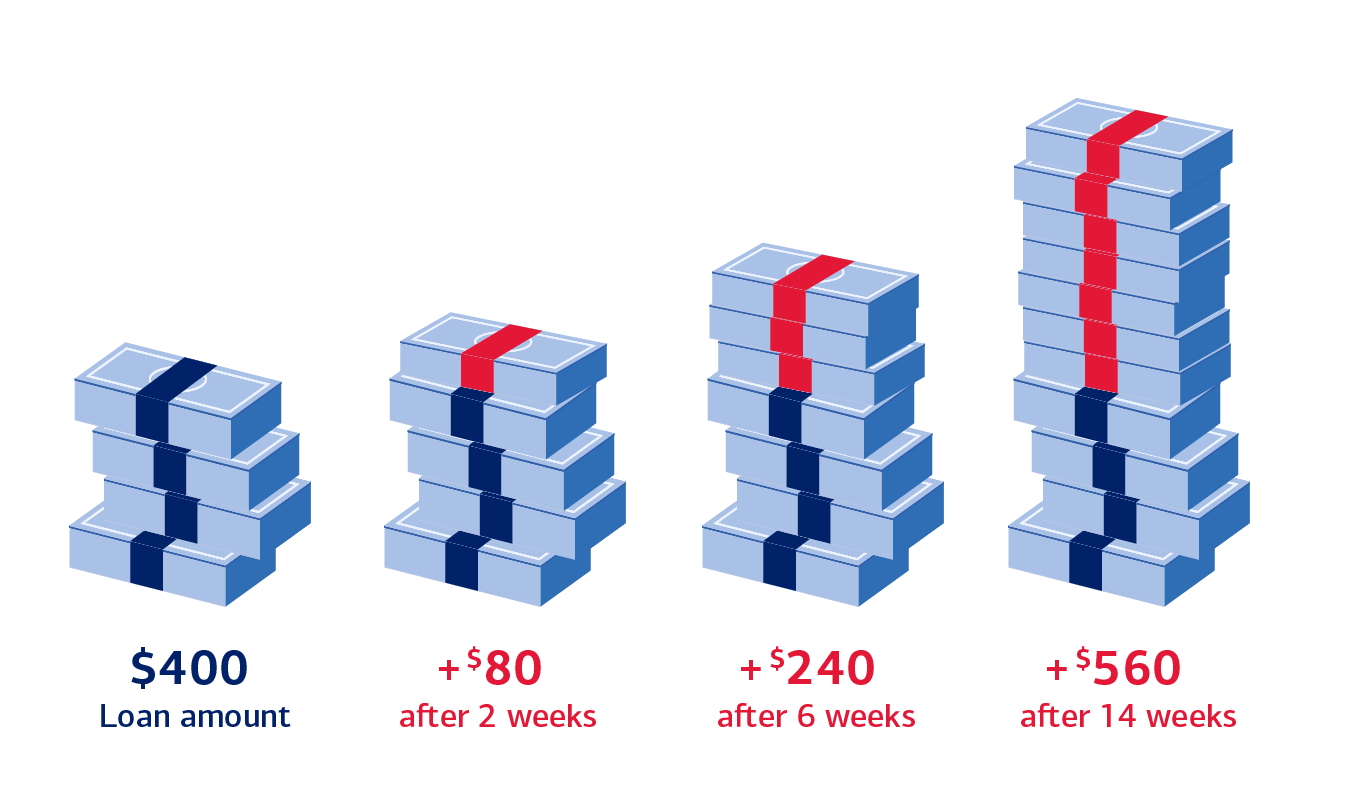

Payday loans are typically fast-cash for small amounts that must be repaid in a single payment. If they are not repaid in full by the due date, additional fees are typically charged and the due date is extended. This can lead to a vicious cycle of re-upping over and over again, incurring more fees each time.

As a result, payday loans increase the chance of bankruptcy.